Uncertainties hang over the cocoa market, indicates the latest monthly report from the International Cocoa Organization (ICCO).

In producing countries, supply is currently down, as we have seen week after week since October 1 in our raw materials column. Between October 1 and November 6, a 23% drop in volumes to 348,000 tonnes (t) was recorded in Côte d'Ivoire, in particular due to the floods which made it very difficult to transport the beans. If the torrential rains persist, yields could be impacted as the soil will be emptied of its nutrients. The skyrocketing cost of inputs, especially fertilizers, will not help the situation. Above all, there are fears of the appearance of the brown rot disease linked to excess humidity.

Ghana, for its part, has not recently updated its figures for the 2022/23 campaign and yet the situation in this country is being watched like milk on the fire because a drop in production is expected compared to the last season, in particular because of the impact of the swollen shoot disease, but also of illegal mining activities on cocoa plantations and the reduced use - also in Ghana - of fertilizers given their high cost.

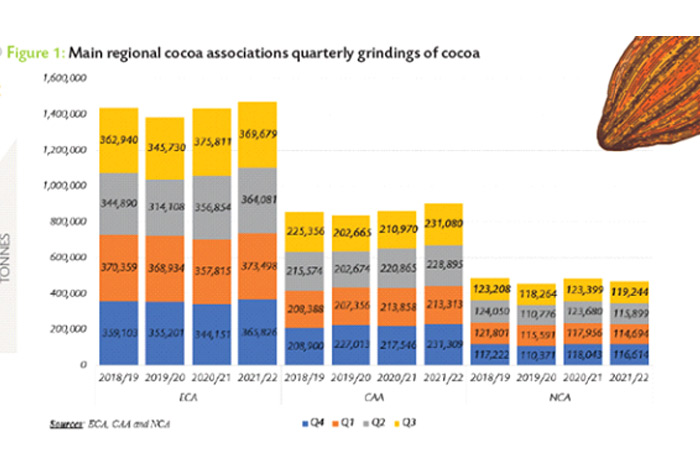

Faced with this, demand is also uncertain, varying very strongly from one region to another. Over the 2021/22 campaign, if grindings in Europe increased by 2.68%, from 41,434,631 t to 1,473,084 t, and by 4.79% in Asia, from 863,239 t to 904,597 t , on the other hand, those in North America fell by 3.44%, contracting from 483,078 t to 466,451 t. And the outlook for 2022/23 is even more hazy: while Asia is in insolent health with an increase of 9.53%, grinding activity in Europe and North America fell by 1.53% respectively. and 3.37%.

"The latest mixed grinds data suggests that cocoa demand at the start of the 2022/23 season remains uncertain due to the current global macroeconomic discourse of high inflation, interest rates, slow growth and concerns over energy price increases," says the ICCO.

What do the prices say? In the first month of the 2022/23 campaign, i.e. the month of October, if prices in London rose by 2% while New York remained stable, they are both 11% lower than their October 2021 levels.

Source : COMMODAFRICA